is idaho tax friendly to retirees

Retirement income exclusion from 35000 to 65000. Social Security income is not taxed.

Fold Out Road Maps Road Trip Planning Idaho Trip

Idaho property tax breaks for retirees for 2022 homeowners age 65 or older with income of 32230 or less are eligible for a property tax.

. Contents1 What are the benefits of retiring in Idaho2. The Idaho Retirement Benefits Deduction may be available to retirees who are both disabled and receive a qualifying source of retirement income. 985 on incomes over.

Idaho allows for a subtraction of retirement income on your state return if the taxpayer meets both parts of the two-part qualification that the state requires. Alaska is one of the most beautiful states in the US. If you have a 500000 portfolio be prepared to have enough income for your retirement.

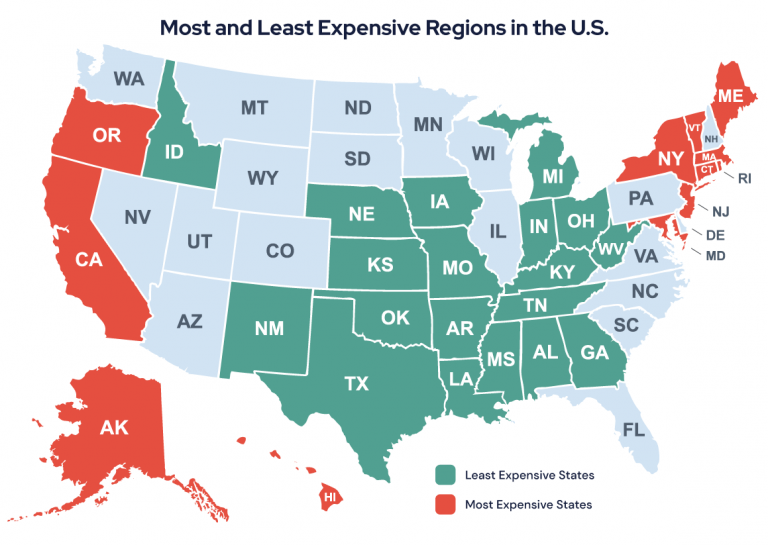

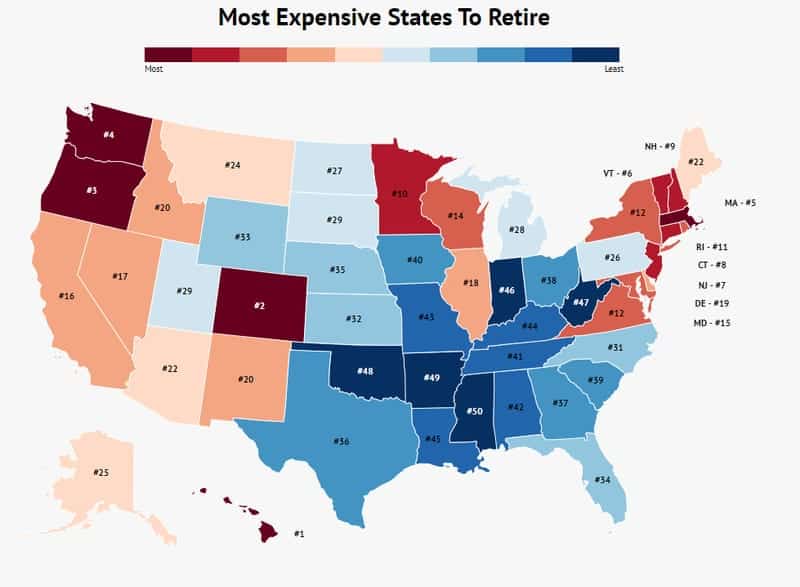

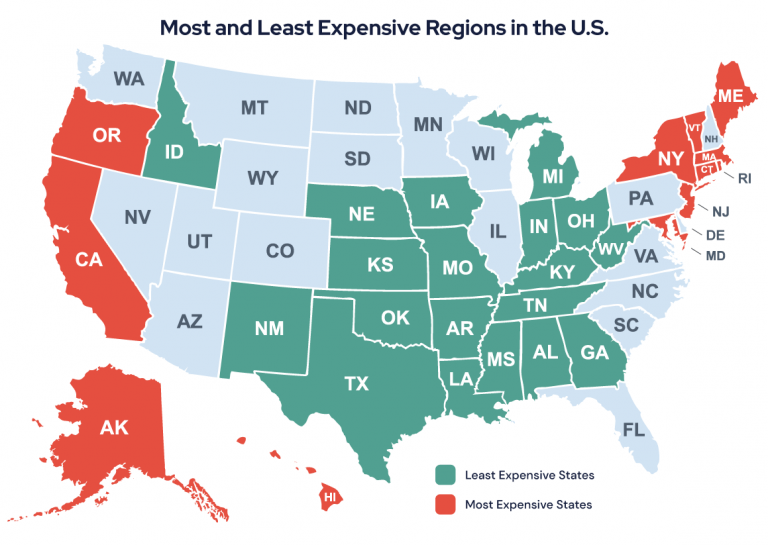

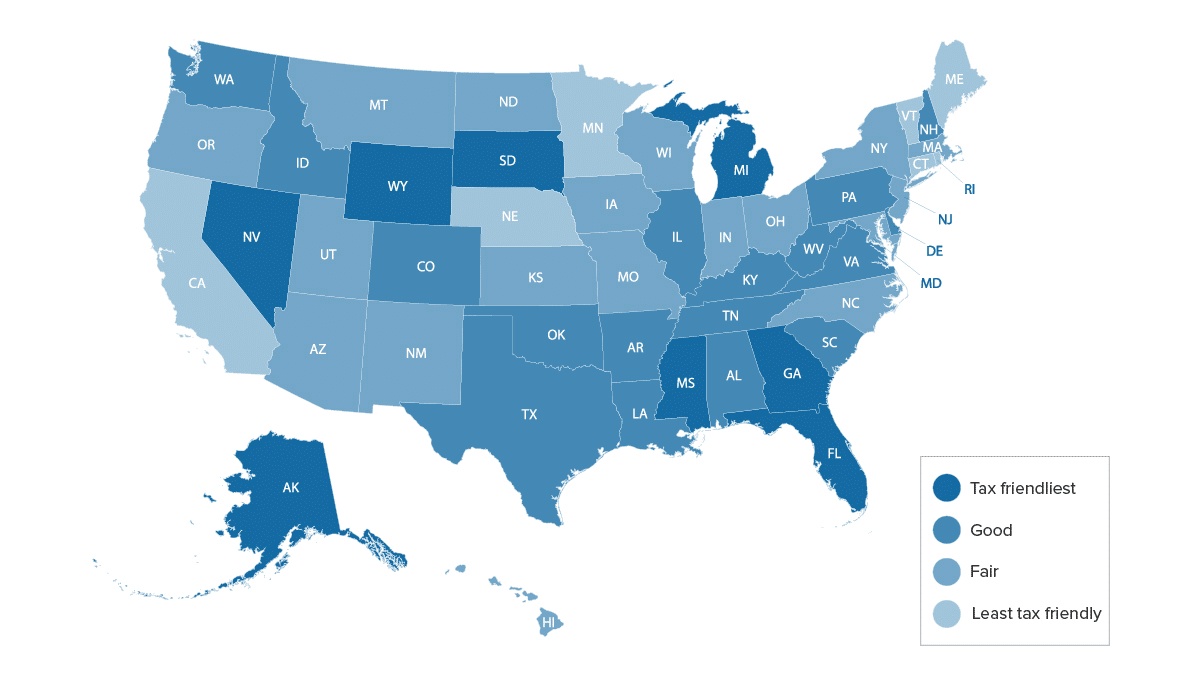

Retirees benefit from a relatively low property tax and no tax on Social Security income in Idaho. Idaho is one of the most tax-friendly states in the country for retirees. Then below the map link to more content about state taxes on retirees including our picks for the 10 most tax-friendly and the 10 least tax-friendly states for retirees.

Tax friendly states charge fewer taxes that might apply to retirees like income tax capital gains tax property tax and sales tax. AL has state taxes ranging from 4 - 75 and property taxes that are some of. Part 1 Age Disability and Filing.

Recipients must be at least age 65 or be. This guide lists some resources that can be useful to Idaho senior citizens and retirees. Withdrawals from retirement accounts are fully taxed.

There is no state income. Its a hikers paradise. Low property tax is especially important for many.

Social Security income is not taxed. 404-417-6501 or 877-423-6177 or dorgeorgiagovtaxes. Is Idaho Tax Friendly To Retirees.

Idaho residents must pay tax on their total income including income. Other retirement income is taxed as regular income ranging from 2 to 5. Depending on where you live when you retire you may have to pay all of these taxes or just a few.

But income tax is the 4th highest on the list. Idaho Property Tax Breaks for Retirees For 2022 homeowners age 65 or older with income of 32230 or less are eligible for a property tax reduction of up to 1500. Idaho is a great place to retire for many reasons but one of the biggest is the states tax laws.

133 on incomes over 1 million 1198024 for married filers of joint returns but Social Security benefits arent taxed here. With its majestic mountains and abundant wildlife. Ad Download The 15-Minute Retirement Plan by Fisher Investments.

Idaho is tax-friendly toward retirees. It also happens to be the most tax friendly state. 800-352-3671 or 850-488-6800 or.

Most Tax Friendly States For Retirees Ranked Goodlife

The 10 Most Expensive States To Retire And The Least Expensive Zippia

Most Tax Friendly States For Retirees Ranked Goodlife

Idaho Retirement Tax Friendliness Smartasset

Top 8 States For Retired Taxpayers Otosection

Idaho Retirement Tax Friendliness Smartasset

18 Pros And Cons Of Retiring In Idaho 2020 Aging Greatly

Idaho Retirement Tax Friendliness Smartasset

Best Places To Retire In Idaho

Best Worst States To Retire In 2022 Guide

West Virginia Is Third Best State For Retirement Survey Says Wboy Com

Idaho Retirement Guide Idaho Best Places To Retire Top Retirements

Idaho Retirement Taxes And Economic Factors To Consider

Retirees Aren T Moving To Idaho For Its Taxes Idaho Business Review

Where Retirees Are Moving 2020 Edition

Is 2 Million Enough To Retire At 60 Case Study

Most Tax Friendly States For Retirees Ranked Goodlife

Best Cities To Retire In 2022 Retirement Living

Map Here Are The Best And Worst U S States For Retirement In 2020